The CFA Program is an advanced program for serious finance professionals and risk managers. But is the CFA useful to traders? Do you need the CFA for trading?

Numerous European masters in finance such as the MSc in Finance and Investments at the RSM or the MFin at LBS offer tracks that specially prepare students for the first level of the CFA.

However, those master’s programs generally focus on corporate finance, portfolio management, and accounting practices, and not really on trading and how to trade the markets.

Most of the MSc in Finance graduates end up taking careers in the Big 4 accounting firms or corporate finance jobs at banks or large multi-national corporations (MNC) such as Unilever or Shell. A few land jobs in portfolio management or market-related jobs such as middle-office or risk departments.

In sum, the majority of MSc in Finance programs that prepare you for the CFA are targeted to finance students that want to pursue careers in traditional finance, but not necessarily in trading.

What Is The CFA Program

The Chartered Financial Analyst (CFA) charter is a professional designation awarded by the CFA Institute to candidates who have successfully passed its rigorous program. It’s a 3-level examination program that will cost you at least US$2400 and 3 years of what could easily run into more than 900 hours of total study time.

The charter is generally equivalent to a postgraduate study and thus you’re expected to have previously completed a bachelor’s or equivalent to be able to earn it. Add at least 4000 hours of relevant work experience that must be gathered in at least 3 years and you can see why it’s the most coveted designation in the field of finance.

Many CFA students take the program as an alternative to an MBA, mainly because it’s possible to take the CFA while employed full-time, and because the CFA may be more suited for those interested in finance rather than general business management.

The CFA Curriculum

The CFA program curriculum is extensive and very intense and focuses on ethics, economics, corporate finance, financial reporting, quantitative analysis, statistics, equity, fixed income, derivatives, alternative investments, portfolio management, among others.

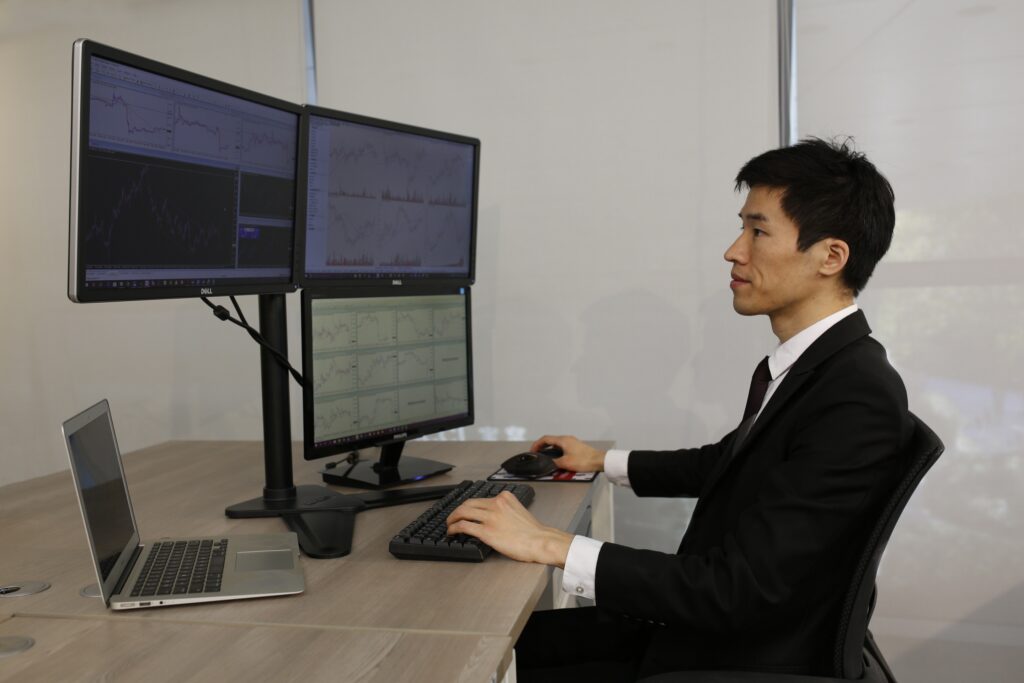

CFA Careers

Typically, CFA graduates develop their careers as

- Portfolio managers

- Research Analysts

- Consultants

- Risk analysts / Risk Managers

- Investment strategists

In the following industries:

- Asset management

- Private wealth management

- Commercial banking

- Investment banking

- Insurance

The CFA is an advanced financial program that prepares candidates for careers in investing and investment management. But does it prepare you to be a trader?

The CFA is an advance financial program that prepares candidates for careers in investing and investment management.

But does it prepare you to be a trader?

Well, the CFA mainly takes you through the world of finance and investments rather than just trading.

The program reviews extensively advanced market-related topics such as bonds, derivatives, equity, forex, commodities but does not teach you how to trade those markets.

The CFA syllabus includes learning about the mechanics of the financial instruments that make trading possible (ie markets, derivatives, options, futures, swaps), but its focus is on understanding, not trading tactics and trading profits (P&L). Thus the CFA contribution to trading performance is very limited.

This is mainly because trading is a very tough career: very hard to get in, very hard to perform consistently, and very hard to stay in the game.

Thus, the CFA charter would most certainly not determine whether you will be a successful trader. It might contribute to understanding the fundamental aspects of the market but not necessarily be conducive to sustained profits.

Alternative Certifications For Traders

Given that the CFA may not be the best shot for those interested in trading, are there any alternative certifications for traders more suited than the CFA?

Certified Market Technician (CMT)

The Certified Market Technician (CMT) awarded by the CMT Association is a major alternative to the CFA for those candidates with clear intentions to become traders.

Just like the CFA, the CMT is a 3-level self-study professional certification program.

However, the main focus of the CMT lies in understanding the markets, as it primarily focuses on classical technical analysis.

The CMT is more affordable, should take significantly fewer hours of preparation, and can be taken by anyone, as candidates don’t need any prior college degree or trading experience to enroll. In any case, you will need at least 3 years of professional experience to get the designation and become a member.

While the CMT program on its own may not be enough to become a successful trader, it focuses mainly on the market and how to understand market performance with the help of classical charting tools such as head and shoulders, wedges, triangles, trends, and more.

Closing Remarks

As a trader, especially a retail trader, you’re competing with lots of big players who have invested millions of dollars in machines that increase their chances of success.

At the present time, there is no educational program that will lead you to become a successful trader. They may teach you how to trade, but they will certainly not make you a profitable trader.

On the one side, trading has never been easier: there are plenty of free brokers such as Robinhood that will take your orders, free charting services such as TradingView that will allow you to analyse the markets, and increased connectivity thanks to the prevalence of the smartphones.

However, profitable trading remains very complex and it is becoming even harder to make money due to the advance of high-frequency trading firms, algorithmic trading, and the changes in the market composition.

Thus, it is quite naïve to think that you can compete with the leading trading firms and institutional whales simply by having a device connected to the internet and pressing buy or sell.

So neither the CFA nor the CMT will make you a successful trader.

What To Do Then?

I seriously question the decision-making abilities of any trader who thinks studying for the CFA is a better use of time than learning to code

— TexasHedge.eth (@0xTexasHedge) February 18, 2023

First, you should re-evaluate your motivations for becoming a trader. Trading is hard and is absolutely not for everyone. Make sure you’re committed to becoming a trader before putting your capital at risk.

Second, we’d certainly recommend learning continuously about the markets, instruments, and products. Whether on your own, with unguided learning or reading lists, or taking part in a program such as the CFA or the CMT.

In the pursuit of successful trading, continuous learning is a necessary condition, but not sufficient.

Recommended areas of learning include fundamental analysis, industry knowledge of specific products (say gold or coffee), trading psychology, and python/R for data analysis in order to develop models of algorithmic trading strategies.